If you're a condo board member and you do not have a background in accounting, chances are bookkeeping and accounting for your corporation will seem l like a daunting task. To many extents, it really is a large undertaking if you do not have a basic understanding of the functions. Or if you're someone with an understanding of accounting for yourself or another business, you need to be in tune with the intricacies and particularities of accounting for condos.

Whether you're a self-managed corporation or one that has hired a management company, it is always a good idea to understand the basics in order to ensure the well-being of your corporation. In this post, we cover the basics of bookkeeping and accounting for condos.

1. The Fundamentals of the Balance Sheet

A balance sheet in general, is a snapshot of a corporation's financial standing at a given moment in time. Think of it as a picture taken of the corporation's finances. The balance sheet reveals the amount of money is in the bank accounts along with assets and liabilities. This is the best way to gain an understanding of the corporation's finances at any time. Common items you'll see in the balance sheet are items such as insurance payments, interest, vendor payments and so on.

2. General Ledger Accounting

A general ledger is essentially a list of all of the corporation's financial transaction. The transactions are ordered by date and numerically. A proper accounting system will help you sort through the list by categories, dates or any other variable. This specific document allows anyone to go into the details pertaining to specific transactions when such is needed.

3. Statements of Income and Expenses

In contrast to the general ledger where you would see a list of all transactions, the Statements of Income and Expenses shows all of the corporation's financial transactions during a given month. This is useful for instances where the board wants to see whether the corporation was over or under the budget for a given month. This document becomes very handy when looking to make decisions based on what is happening from a financial standpoint.

4. Cheque Register

This document keeps track of all of the cheques that a corporation writes. It goes into detail as to who the cheque was issued to, the date, the invoices it addresses and so on.

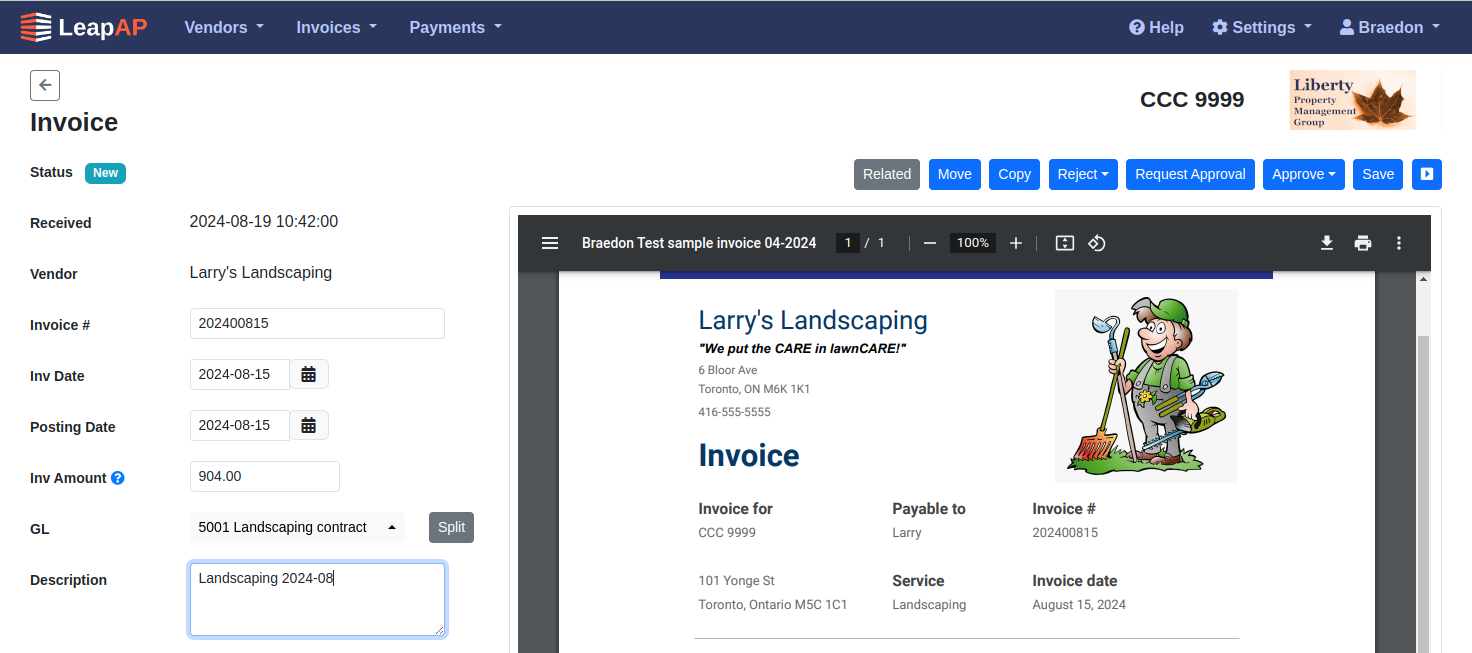

5. Accounts Payable

Self-explanatory, the accounts payable tracks all of the unpaid expenses for the corporation. Items are generally tied to an invoice that is not yet due or for work that has not yet been completed by say, a vendor. The accounts payable list allows the corporation to properly anticipate its future cash flows.

6. Annual Audits

Many corporations require an annual financial audit in order to ensure that the corporation is in good standing. This is done by an accounting firm with the help of the financials produced by the management company or the board with their accounting software. The ability to pull reports in a timely manner is one of the keys of a condo accounting software as it saves the accountant much time.

If done manually, in other words without the help of a proper condo accounting software, bookkeeping/accounting in condos can become a nightmare. However, with the right tools and software, you can spend a fraction of the time tracking and allocate most of the time to making proper decisions with your board with respect to financials. We at Condo Manager work with thousands of boards and would be more than happy to see if our software can be useful for you. Feel free to give us a shout!